Rich people.

#16

Posted 02 March 2011 - 01:53 PM

#17

Posted 02 March 2011 - 01:58 PM

though i disagree that if everyone should pay the same in taxes (that's communism!

all the sudden rich people want everyone to pay the same!) and sadly that's not currently how our tax system works. if you make 10Mil, you pay less in taxes than someone who makes 10K

i love you jacki, but i think that's totally false. please show me the math. i presume you're talking in terms of % of total income (not in terms of actual dollars). still, it's false.

here are the 2011 brackets. somebody making 10k pays less in %. not to mention that the standard deduction is something like $1500, so they might not pay anything anyway:

Tax Bracket Married Filing Jointly Single

10% Bracket $0 – $17,000 $0 – $8,500

15% Bracket $17,001 – $69,000 $8,501 – $34,500

25% Bracket $69,001 – $139,350 $34,501 – $83,600

28% Bracket $139,351 – $212,300 $83,601 – $174,400

33% Bracket $212,301 – $379,150 $174,401 – $379,150

35% Bracket Over $379,150 Over $379,150

edit: sorry about the formatting - i pasted it in and can't get the margins right.

Myspace

My thesis is called the "Black-Emperor-Says Theory" and holds that any any Phoenix-area indie rock festival there is a 100 percent probability that Emperors of Japan, Black Carl, and/or What Laura Says will be on the bill.

- Martin Shizzmore

#18

Posted 02 March 2011 - 02:13 PM

Either way is messed up if you ask me.

#19

Posted 02 March 2011 - 02:54 PM

So you think the 10% bracket should pay 35% or the 35% should pay 10%?

Either way is messed up if you ask me.

i would be okay with people in the higher brackets paying 10%. but that's not ever going to happen, so it doesn't matter what i think there.

to me, messed up is telling somebody that they're paying 3 times as much in taxes (as a percentage of their income) as someone who makes less than them. then you're saying on top of that, the deductions that are applicable to other people aren't applicable to them. people at the higher end of the spectrum are already paying more, by a considerable margin, than people at the lower end.

i guess there are probably extreme cases where people have found ways to save millions in taxes because of loopholes and investment incentives, but these people are still already paying millions in taxes.

i'd also like to point out that many people are reading this and saying "yeah, stick it to those rich people." well, guess what - you're probably closer to being considered wealthy or upper class than you think.

Myspace

My thesis is called the "Black-Emperor-Says Theory" and holds that any any Phoenix-area indie rock festival there is a 100 percent probability that Emperors of Japan, Black Carl, and/or What Laura Says will be on the bill.

- Martin Shizzmore

#20

Posted 02 March 2011 - 03:07 PM

#21

Posted 02 March 2011 - 03:09 PM

My link

My link

40% of US households make below $36,000

60% make below $57,000

80% make below $91,750

95% making below $165k

98% making less than $250,000

99.99% make less than $5 million and 0.01% make more than $5 million (with a very special category for those making over $1.5 billion: "Hedge Fund Managers")

1% of society makes 17.3% of the income,

The average income in the top 0.01%, or 11,000 households, is $35,473,200, and a minimum of $8,579,000

My link

My link

The richest 1 percent of Americans now take home almost 24 percent of income, up from almost 9 percent in 1976. As Timothy Noah of Slate noted in an excellent series on inequality, the United States now arguably has a more unequal distribution of wealth than traditional banana republics like Nicaragua, Venezuela and Guyana.

The United States of Inequality by Timothy Slate

This was the era in which the accumulated wealth of America's richest families—the Rockefellers, the Vanderbilts, the Carnegies—helped prompt creation of the modern income tax, lest disparities in wealth turn the United States into a European-style aristocracy. The socialist movement was at its historic peak, a wave of anarchist bombings was terrorizing the nation's industrialists, and President Woodrow Wilson's attorney general, Alexander Palmer, would soon stage brutal raids on radicals of every stripe. In American history, there has never been a time when class warfare seemed more imminent.

That was when the richest 1 percent accounted for 18 percent of the nation's income. Today, the richest 1 percent account for 24 percent of the nation's income.

During the late 1980s and the late 1990s, the United States experienced two unprecedentedly long periods of sustained economic growth—the "seven fat years" and the " long boom." Yet from 1980 to 2005, more than 80 percent of total increase in Americans' income went to the top 1 percent.

in particular this sub-article from the slate article focuses on tax inequality in america

Liberal politicians and activists have long argued that the federal government caused the Great Divergence. And by "federal government," they generally mean Republicans, who have controlled the White House for 20 of the past 30 years, after all. A few outliers even argue that for Republicans, creating income inequality was a conscious and deliberate policy goal.

efore Ronald Reagan's election in 1980, the top income tax bracket stood at or above 70 percent, where it had been since the Great Depression. (In the 1950s and the Mad Men early 1960s, the top bracket exceeded 90 percent!) Throughout the Great Compression, as the economy boomed and income inequality dwindled, the top bracket resided at a level that even most Democrats would today call confiscatory. Reagan dropped the top bracket from 70 percent to 50 percent, and eventually pushed it all the way down to 28 percent. Since then, it has hovered between 30 percent and 40 percent. If President Obama lets George W. Bush's 2001 tax cut expire for families earning more than $250,000, as he's expected to do, Tea Partiers will call him a Bolshevik. But at a whisker under 40 percent (up from 35), the top bracket would remain 30 to 50 percentage points below what it was under Presidents Eisenhower, Nixon, and Ford. That's how much Reagan changed the debate.

But tax brackets, including the top one, tell you only the marginal tax rate, i.e., the rate on the last dollar earned. The percentage of total income that you actually pay in taxes is known as the effective tax rate. That calculation looks at income taxed at various rates as you move from one bracket to the next; it figures in taxes on capital gains and pensions; it figures in "imputed taxes" such as corporate and payroll taxes paid by your employer (on the theory that if your boss didn't give this money to Uncle Sam he'd give it to you); and it removes from the total any money the federal government paid you in Social Security, welfare, unemployment benefits, or some other benefit. Reagan lowered top marginal tax rates a lot

In 1979, the effective tax rate on the top 0.01 percent (i.e., rich people) was 42.9 percent, according to the Congressional Budget Office. By Reagan's last year in office it was 32.2 percent. From 1989 to 2005 (the last year for which data are available), as income inequality continued to climb, the effective tax rate on the top 0.01 percent largely held steady; in most years it remained in the low 30s, surging to 41 during Clinton's first term but falling back during his second, where it remained.

Overall, pre-tax income increased 1.42 percent annually for the 20th percentile (poor and lower-middle-class people) and 2 percent annually for the 95th percentile (upper-middle-class and rich people). The White House during this period was occupied by five Democrats (Truman, Kennedy, Johnson, Carter, Clinton) and six Republicans (Eisenhower, Nixon, Ford, Reagan, Bush I, Bush II). Bartels plotted out what the inequality trend would have been had only Democrats been president. He also plotted out what the trend would be had only Republicans been president.

In Democrat-world, pre-tax income increased 2.64 percent annually for the poor and lower-middle-class and 2.12 percent annually for the upper-middle-class and rich. There was no Great Divergence. Instead, the Great Compression—the egalitarian income trend that prevailed through the 1940s, 1950s, and 1960s—continued to the present, albeit with incomes converging less rapidly than before. In Republican-world, meanwhile, pre-tax income increased 0.43 percent annually for the poor and lower-middle-class and 1.90 percent for the upper-middle-class and rich. Not only did the Great Divergence occur; it was more greatly divergent. Also of note: In Democrat-world pre-tax income increased faster than in the real world not just for the 20th percentile but also for the 40th, 60th, and 80th. We were all richer and more equal! But in Republican-world, pre-tax income increased slower than in the real world not just for the 20th percentile but also for the 40th, 60th, and 80th. We were all poorer and less equal! Democrats also produced marginally faster income growth than Republicans at the 95th percentile, but the difference wasn't statistically significant.

Income Inequality: Issues and Policy Options

by Alan Greenspan

The Level and Distribution of Economic Well-Being by Ben S. Bernanke

My link

But where Laffer's squiggle was an argument to lower taxes, Piketty and Saez's (the conservative Henninger noted with some dismay) was to raise them on the Rich.

A different logic applies to Jacob Hacker and Paul Pierson's theory that inequality was created largely by a growth in corporate lobbying that influenced both Republicans and Democrats. Their construct is a conscious effort to incorporate Saez and Piketty's research into a government-based model. In Hacker and Pierson's view, if you can't explain the rise of the Stinking Rich then you can't explain the Great Divergence—or at least what I'll call the Great Divergence Part II, which began in the 1990s and continued through the aughts as the more humdrum quintile-based divergence essentially halted (the bottom 20 percent actually crept up a little). Egalitarians could have declared victory if incomes for the Stinking Rich hadn't continued spurting upward like Old Faithful.

who rules america?

and finally

Inheritance and estate taxes

Figures on inheritance tell much the same story. According to a study published by the Federal Reserve Bank of Cleveland, only 1.6% of Americans receive $100,000 or more in inheritance. Another 1.1% receive $50,000 to $100,000. On the other hand, 91.9% receive nothing (Kotlikoff & Gokhale, 2000). Thus, the attempt by ultra-conservatives to eliminate inheritance taxes -- which they always call "death taxes" for P.R. reasons -- would take a huge bite out of government revenues (an estimated $1 trillion between 2012 and 2022) for the benefit of the heirs of the mere 0.6% of Americans whose death would lead to the payment of any estate taxes whatsoever (Citizens for Tax Justice, 2010b).

It is noteworthy that some of the richest people in the country oppose this ultra-conservative initiative, suggesting that this effort is driven by anti-government ideology. In other words, few of the ultra-conservative and libertarian activists behind the effort will benefit from it in any material way. However, a study (Kenny et al., 2006) of the financial support for eliminating inheritance taxes discovered that 18 super-rich families (mostly Republican financial donors, but a few who support Democrats) provide the anti-government activists with most of the money for this effort. (For more infomation, including the names of the major donors, download the article from United For a Fair Economy's Web site.)

Actually, ultra-conservatives and their wealthy financial backers may not have to bother to eliminate what remains of inheritance taxes at the federal level. The rich already have a new way to avoid inheritance taxes forever -- for generations and generations -- thanks to bankers. After Congress passed a reform in 1986 making it impossible for a "trust" to skip a generation before paying inheritance taxes, bankers convinced legislatures in many states to eliminate their "rules against perpetuities," which means that trust funds set up in those states can exist in perpetuity, thereby allowing the trust funds to own new businesses, houses, and much else for descendants of rich people, and even to allow the beneficiaries to avoid payments to creditors when in personal debt or sued for causing accidents and injuries. About $100 billion in trust funds has flowed into those states so far. You can read the details on these "dynasty trusts" (which could be the basis for an even more solidified "American aristocracy") in a New York Times opinion piece published in July 2010 by Boston College law professor Roy Madoff, who also has a book on this and other new tricks: Immortality and the Law: The Rising Power of the American Dead (Yale University Press, 2010).

When all taxes (not just income taxes) are taken into account, the lowest 20% of earners (who average about $12,400 per year), paid 16.0% of their income to taxes in 2009; and the next 20% (about $25,000/year), paid 20.5% in taxes. So if we only examine these first two steps, the tax system looks like it is going to be progressive.

And it keeps looking progressive as we move further up the ladder: the middle 20% (about $33,400/year) give 25.3% of their income to various forms of taxation, and the next 20% (about $66,000/year) pay 28.5%. So taxes are progressive for the bottom 80%. But if we break the top 20% down into smaller chunks, we find that progressivity starts to slow down, then it stops, and then it slips backwards for the top 1%.

Specifically, the next 10% (about $100,000/year) pay 30.2% of their income as taxes; the next 5% ($141,000/year) dole out 31.2% of their earnings for taxes; and the next 4% ($245,000/year) pay 31.6% to taxes. You'll note that the progressivity is slowing down. As for the top 1% -- those who take in $1.3 million per year on average -- they pay 30.8% of their income to taxes, which is a little less than what the 9% just below them pay, and only a tiny bit more than what the segment between the 80th and 90th percentile pays.

#23

Posted 02 March 2011 - 03:22 PM

#24

Posted 02 March 2011 - 03:25 PM

Someone else makes $12K a year and pays around 16% on that.

You make 96% more and only pay %15 more in taxes? and that doesn't include write-offs and other bullshit tax incentives that the rich get.

i call bullshit!*

but you were right tony, my statement about the rich paying the same or less in taxes as the poor was slightly incorrect depending on the numbers, in essence the rich only pay %15 more in taxes than the poor.

and my parents had a "summer" home on lake sara in central il when i was growing up that we all enjoyed. but i would rather have my parents pay taxes on having a second home than disabled people or children with no families go without medical care or access to education or a shelter or food.

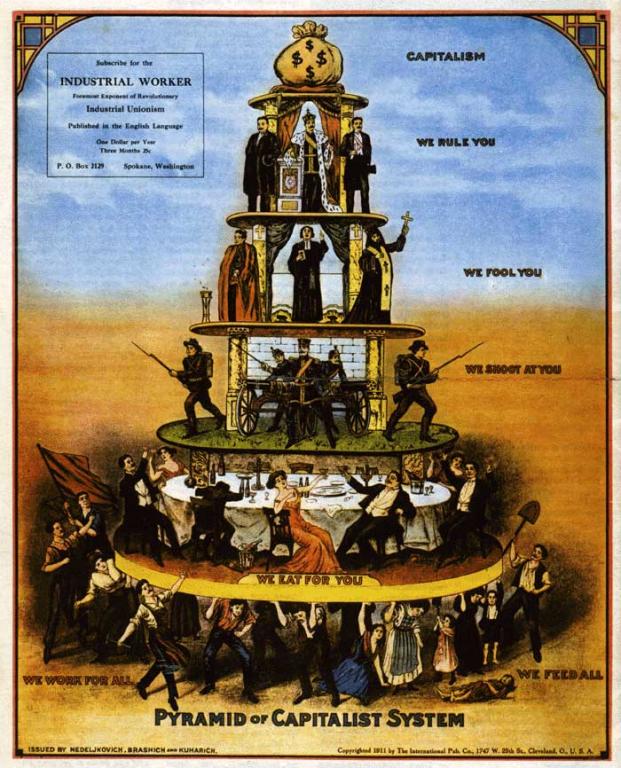

it's clearly evident from the huge change in income distribution and taxation that the rich only care about themselves while selling the poor and middle classes "patriotism" and "national pride" in order to quell any issues that 98% of the population has with inequality. blame it on immigrants right?

and what will happen to the rich when the u.s. economy collapses? nothing. look at the past few years. they keep getting richer.

i am not against a system that encourages innovation or hard work. but we clearly dont have that system because we deny people the basic tools they need in order to even get to the point of innovation or hard work.

#25

Posted 02 March 2011 - 03:47 PM

When all taxes (not just income taxes) are taken into account, the lowest 20% of earners (who average about $12,400 per year), paid 16.0% of their income to taxes in 2009; and the next 20% (about $25,000/year), paid 20.5% in taxes. So if we only examine these first two steps, the tax system looks like it is going to be progressive.

And it keeps looking progressive as we move further up the ladder: the middle 20% (about $33,400/year) give 25.3% of their income to various forms of taxation, and the next 20% (about $66,000/year) pay 28.5%. So taxes are progressive for the bottom 80%. But if we break the top 20% down into smaller chunks, we find that progressivity starts to slow down, then it stops, and then it slips backwards for the top 1%.

Specifically, the next 10% (about $100,000/year) pay 30.2% of their income as taxes; the next 5% ($141,000/year) dole out 31.2% of their earnings for taxes; and the next 4% ($245,000/year) pay 31.6% to taxes. You'll note that the progressivity is slowing down. As for the top 1% -- those who take in $1.3 million per year on average -- they pay 30.8% of their income to taxes, which is a little less than what the 9% just below them pay, and only a tiny bit more than what the segment between the 80th and 90th percentile pays.

i'm not reading all those links. i have a job. but i did read the body of your post. specifically, the last part, which disproves your original argument, jacki. the lowest earners paid 16% and the highest earners paid 30.8%. the top earners are paying slightly less % than the people below them, but it's about 1% less, and that stat only applies to the people in that upper stratosphere. they are not paying less % than the people at the bottom end of the spectrum. it's not even close.

how do you figure that when the "middle class" is disappearing???

maybe it's disappearing because people in the middle class think they can spend money like they're in the upper class. and it's semantics anyways. what i meant was that if you follow the monetary guidelines for classes, you're probably in a higher class than you think. technically speaking, i'm in the upper class, although i don't feel wealthy and certainly can't claim tax deductions on my 2nd vacation home (which i don't have).

in other words, we're sitting around thinking that we need to revolt against rich people while we update our websites from our smart phones and laptops with our college degrees and mortgages and disposable income that we spend on video games and weed. we're not fucking poor. poor people would kick the shit out of us for saying otherwise. but hey, if you guys are doing your taxes and thinking "i should be giving more money to the government because i'm doing great" then go ahead and do it. there's a space for that on the form. and i'll tip my cap to you.

You make 96% more and only pay %15 more in taxes? and that doesn't include write-offs and other bullshit tax incentives that the rich get.

so are you saying i should pay 96% more in taxes? that's fucking insane.

Myspace

My thesis is called the "Black-Emperor-Says Theory" and holds that any any Phoenix-area indie rock festival there is a 100 percent probability that Emperors of Japan, Black Carl, and/or What Laura Says will be on the bill.

- Martin Shizzmore

#26

Posted 02 March 2011 - 03:49 PM

it's clearly evident from the huge change in income distribution and taxation that the rich only care about themselves while selling the poor and middle classes "patriotism" and "national pride" in order to quell any issues that 98% of the population has with inequality. blame it on immigrants right?

that's a pretty big leap, jacki. i don't think it's evident at all. how can you say the rich only care about themselves because the government allows them to be taxed in the current fashion? i gotta go back and agree with rize - you're mad at the rich. you should be mad at the government. and playing the immigrant card here doesn't make sense.

edit: whoops - sorry for the double post - i meant to include this in the previous one.

Myspace

My thesis is called the "Black-Emperor-Says Theory" and holds that any any Phoenix-area indie rock festival there is a 100 percent probability that Emperors of Japan, Black Carl, and/or What Laura Says will be on the bill.

- Martin Shizzmore

#27

Posted 02 March 2011 - 03:52 PM

When all taxes (not just income taxes) are taken into account, the lowest 20% of earners (who average about $12,400 per year), paid 16.0% of their income to taxes in 2009; and the next 20% (about $25,000/year), paid 20.5% in taxes. So if we only examine these first two steps, the tax system looks like it is going to be progressive.

And it keeps looking progressive as we move further up the ladder: the middle 20% (about $33,400/year) give 25.3% of their income to various forms of taxation, and the next 20% (about $66,000/year) pay 28.5%. So taxes are progressive for the bottom 80%. But if we break the top 20% down into smaller chunks, we find that progressivity starts to slow down, then it stops, and then it slips backwards for the top 1%.

Specifically, the next 10% (about $100,000/year) pay 30.2% of their income as taxes; the next 5% ($141,000/year) dole out 31.2% of their earnings for taxes; and the next 4% ($245,000/year) pay 31.6% to taxes. You'll note that the progressivity is slowing down. As for the top 1% -- those who take in $1.3 million per year on average -- they pay 30.8% of their income to taxes, which is a little less than what the 9% just below them pay, and only a tiny bit more than what the segment between the 80th and 90th percentile pays.

i'm not reading all those links. i have a job. but i did read the body of your post. specifically, the last part, which disproves your original argument, jacki. the lowest earners paid 16% and the highest earners paid 30.8%. the top earners are paying slightly less % than the people below them, but it's about 1% less, and that stat only applies to the people in that upper stratosphere. they are not paying less % than the people at the bottom end of the spectrum. it's not even close.how do you figure that when the "middle class" is disappearing???

maybe it's disappearing because people in the middle class think they can spend money like they're in the upper class. and it's semantics anyways. what i meant was that if you follow the monetary guidelines for classes, you're probably in a higher class than you think. technically speaking, i'm in the upper class, although i don't feel wealthy and certainly can't claim tax deductions on my 2nd vacation home (which i don't have).

in other words, we're sitting around thinking that we need to revolt against rich people while we update our websites from our smart phones and laptops with our college degrees and mortgages and disposable income that we spend on video games and weed. we're not fucking poor. poor people would kick the shit out of us for saying otherwise. but hey, if you guys are doing your taxes and thinking "i should be giving more money to the government because i'm doing great" then go ahead and do it. there's a space for that on the form. and i'll tip my cap to you.You make 96% more and only pay %15 more in taxes? and that doesn't include write-offs and other bullshit tax incentives that the rich get.

so are you saying i should pay 96% more in taxes? that's fucking insane.

no. did i write that? you shouldn't because you don't make 1.3million or more every year in income (alone)

but you should pay more than 30%

the argument that taxing the rich will overall hurt the economy/country is incorrect since the upper 1% earners of the nation have had their incomes rise exponentially over the last few decades as their % of tax payouts has gone down.

and the last few years have been the worst economically that we've had since the great depression when, previous to that meltdown, the richest tax rates were more proportionate to their income and the level of income inequality between the rich and the poor hovered around 9-18%

#28

Posted 02 March 2011 - 03:55 PM

it's clearly evident from the huge change in income distribution and taxation that the rich only care about themselves while selling the poor and middle classes "patriotism" and "national pride" in order to quell any issues that 98% of the population has with inequality. blame it on immigrants right?

that's a pretty big leap, jacki. i don't think it's evident at all. how can you say the rich only care about themselves because the government allows them to be taxed in the current fashion? i gotta go back and agree with rize - you're mad at the rich. you should be mad at the government. and playing the immigrant card here doesn't make sense.

edit: whoops - sorry for the double post - i meant to include this in the previous one.

Tony

the rich are the government.

#29

Posted 02 March 2011 - 04:00 PM

stop cleaning their assholes for them, you're not one of them. you dont make millions/billions a year or purchase senate seats do you?

i wasn't "playing the immigrant card" i was stating that that's what our richie rich (democrat and repube-lickin') politicians often blame when income inequality and taxation inequality issues become popular topic.

i do agree with you that the middle class needs to stop trying to live like it's the top 1% of the income earners in this country, but i dont think that alone is the cause of income disparity or economic ruin, though definitely a link in the chain of american demise.

#30

Posted 02 March 2011 - 04:06 PM

no. did i write that? you shouldn't because you don't make 1.3million or more every year in income (alone)

but you should pay more than 30%

the argument that taxing the rich will overall hurt the economy/country is incorrect since the upper 1% earners of the nation have had their incomes rise exponentially over the last few decades as their % of tax payouts has gone down.

and the last few years have been the worst economically that we've had since the great depression when, previous to that meltdown, the richest tax rates were more proportionate to their income and the level of income inequality between the rich and the poor hovered around 9-18%

i realize you're not asking me personally to pay 96% more in taxes. what i meant to say was IF i made 96% more. either way, i was asking in jest.

i'm just not aligned with increasing the individual tax rates just because someone makes more money. that original chart isn't just a list of personal tax cuts, it's corporate tax cuts and a slew of things that are unrelated to personal income. and the deductions that are listed on there apply to people at all levels of the economic spectrum - you just happen to see them more often at the highest level. i think you could successfully argue that eliminating some of the deductions could actually harm the middle class more than the upper class (especially on things like estate tax).

i swear i'm not a republican.

Myspace

My thesis is called the "Black-Emperor-Says Theory" and holds that any any Phoenix-area indie rock festival there is a 100 percent probability that Emperors of Japan, Black Carl, and/or What Laura Says will be on the bill.

- Martin Shizzmore

1 user(s) are reading this topic

0 members, 1 guests, 0 anonymous users